Types of Credit Facilities

There are significantly two kinds of credit facilities; present moment and long haul, where the previous is utilized for working capital necessities of the association including covering off creditors and tabs, while the last is utilized for to meet the capital consumption prerequisites of the endeavour, for the most part, financed through banks, private arrangements, and banks.

|

| credit facility |

Two Types of Credit Facilities

Comprehensively, there are two kinds of credit facilities:

1) Short term loans, for the most part for working capital needs; and

2) Long-term loans, required for capital consumption (contained for the most part of building producing facilities, acquisition of hardware and gear, and development activities) or procurement (which could be jolt on i.e littler in size or could be transformative i.e equivalent size).

Let us examine each sort of credit facility in detail

Short-Term Credit Facilities

The transient borrowings can be transcendent of the accompanying sorts:

#1 – Cash credit and overdraft

Right now credit facility, an organization can pull back assets more than it has in its stores. The borrower would then be required to pay the loan cost which is appropriate just to the sum that has been overdrawn. The size and the loan cost charged on the overdraft facility is ordinarily an element of the borrower's credit score (or rating).

#2 – Short-term loans

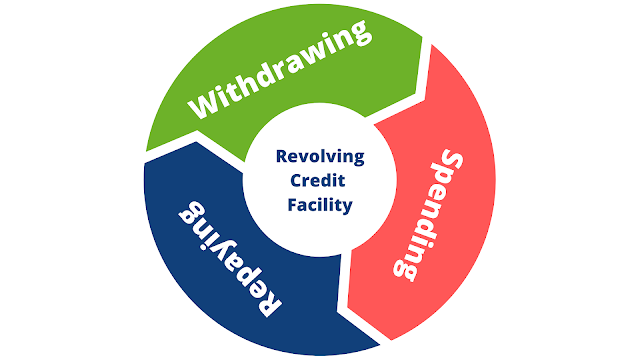

An enterprise may likewise get momentary loans for its working capital needs, the tenor of which might be constrained to as long as a year. This sort of credit facility could possibly be made sure about in nature, contingent upon the credit rating of the borrower. A more grounded borrower (regularly of a speculation grade classification) may have the option to get on an unbound premise. Then again, a non-speculation grade borrower may require giving security to the loans as present resources, for example, receivables and inventories (away or travel) of the borrower. A few enormous organizations additionally obtain spinning credit facilities, under which the organization may acquire and reimburse assets on a progressing premise inside a predefined sum and tenor. These may length for as long as 5 years and includes responsibility expense and somewhat higher financing cost for the expanded adaptability contrasted with conventional loans (which don't recharge after instalments are made).

An acquiring base facility is a made sure about type of momentary loan facility gave fundamentally to the items exchanging firms. Obviously, the loan to esteem proportion, i.e the proportion of the sum loaned to the estimation of the basic guarantee is constantly kept up at short of what one, something close to 75-85%, to catch the danger of a potential decrease in the estimation of the benefits.

#3 – Trade money

This sort of credit facility is basic for a proficient money change pattern of an organization, and can be of the accompanying kinds:

- Credit from providers: A provider is normally increasingly OK with giving credit to its clients, with whom it has solid connections. The arrangement of the instalment terms with the provider is critical to make sure about a productive exchange. A case of the provider instalment term is "2% 10 Net 45", which means that the price tag would be offered at a 2% markdown by the provider whenever paid inside 10 days. Then again, the organization would need to follow through, on the whole, indicated by cost, however, would have the adaptability to broaden the instalment by 35 additional days.

- Letters of Credit: This is an increasingly secure type of credit, wherein a bank ensures the instalment from the organization to the provider. The giving bank (i.e the bank which gives the letter of credit to the provider) plays out its own due persistence and typically requests guarantee from the organization. A provider would incline toward this game plan, as this helps address the credit chance issue concerning its client, which might be situated in a precarious locale.

- Fare credit: This type of loan is given to the exporters by government offices to help trade development.

- Considering: Factoring is a propelled type of getting, wherein the organization offers its records receivables to another gathering (called a factor) at a rebate (to make up for moving the credit hazard). This course of action could assist the organization with getting the receivables expelled from its accounting report, and can serve to fill its money needs.

Long-Term Credit Facilities

Presently, we should see to what extent term credit facilities are normally organized. They can be obtained from a few sources – banks, private position, and capital markets, and are at different levels in an instalment default cascade.

#1 – Bank loans

The most widely recognized kind of long haul credit facility is a term loan, which is characterized by a particular sum, tenor (that may fluctuate from 1-10 years) and a predefined reimbursement plan. These loans could be made sure about (as a rule for higher-chance borrowers) or unbound (for venture grade borrowers), and are for the most part at drifting rates (i.e a spread over LIBOR or EURIBOR). Prior to loaning a long haul facility, a bank performs broad due tirelessness so as to address the credit hazard that they are approached to expect given the long haul tenor. With increased ingenuity, term loans have the most minimal expense among other long haul obligation. The due persistence may include the incorporation of contracts, for example, the accompanying:

-

Support of influence proportions and inclusion proportions, under which the bank may request that the enterprise looks after Debt/EBITDA at under 0x and EBITDA/Interest at more than 6.0x, in this way in a roundabout way confining the corporate from assuming extra obligation past a specific breaking point.

-

Change of control arrangement, which implies that a predefined segment of the term loan must be reimbursed, on the off chance that the organization gets gained by another organization.

-

Negative promise, which keeps borrowers from swearing all or a segment of its benefits for making sure about extra bank loans (in any event, for the subsequent lien), or offer of advantages without authorization

-

Confining mergers and acquisitions or certain capital consumption

-

The term loan can be of two kinds – Term Loan A "TLA" and Term Loan B "TLB". The essential contrast between the two is the amortization plan – TLA is amortized uniformly more than 5-7 years, while TLB is amortized ostensibly in the underlying years (5-8 years) and remembers a huge projectile instalment for the most recent year. As you speculated accurately, TLB is somewhat progressively costly to the Company for the marginally expanded tenor and credit chance (inferable from late head instalment).

#2 – Notes

These sorts of credit facilities are raised from private arrangement or capital markets and are commonly unbound in nature. To make up for the improved credit chance that the moneylenders are happy to take, they are costlier for the organization. Subsequently, they are considered by the company just when the banks are not happy with further loaning. This kind of obligation is ordinarily subjected to the bank loans, and are bigger in the tenor (up to 8-10 years). The notes are typically renegotiated when the borrower can raise obligation at less expensive rates, be that as it may, this requires a prepayment punishment as "make entire" instalment notwithstanding the chief instalment to the loan specialist. A few notes may accompany a call alternative, which permits the borrower to prepay these notes inside a predetermined time period in circumstances where renegotiating with less expensive obligation is simpler. The notes with call alternatives are moderately less expensive for the loan specialist i.e charged at higher financing costs than ordinary notes.

#3 – Mezzanine obligation

The mezzanine obligation is a blend among obligation and value and rank rearward in the instalment default cascade. This obligation is totally unbound, senior just to the regular offers, and junior to the next obligation in the capital structure. Inferable from the improved hazard, they require an arrival pace of 18-25% and are given uniquely by private value and mutual funds, which typically put resources into more dangerous resources. The obligation like structure originates from its money pay a premium, and development running from 5-7 years; while the value like structure originates from the warrants and instalment in-kind (PIK) related to it. PIK is a segment of intrigue, which as opposed to paying intermittently to the moneylenders, is added to the chief sum and reimbursed uniquely at development. The warrants may length between 1-5% of the complete value capital and gives the banks the alternative to purchase the organization's stock at a foreordained low cost, on the off chance that the moneylender sees the organization's development direction emphatically. The mezzanine obligation is normally utilized in a utilized buyout circumstance, in which a private value financial specialist purchases an organization with as high obligation as could be expected under the circumstances (contrasted with value), so as to amplify its profits on value.

#4 – Securitization

This kind of credit facility is fundamentally the same as the figuring of receivables referenced before. The main contrast is the liquidity of advantages and the organizations in question. In calculating, a monetary foundation may go about as a "factor" and buy the Company's exchange receivables; be that as it may, in securitization, there could be different gatherings (or speculators) and longer-term receivables included. The instances of securitized resources could be credit card receivables, contract receivables, and non-performing resources (NPA) of a monetary organization.

#5 – Bridge loan

Another sort of credit facility is an extension facility, which is generally used for M&A or working capital purposes. A scaffold loan is the regularly present moment in nature (for as long as a half year), and are obtained for an interval utilization, while the organization anticipates long haul financing. The extension loan can be reimbursed, utilizing bank loans, notes, or even value financing, when the business sectors go helpful for raising capital.

All in all, there should be a harmony between the organization's obligation structure, value capital, business hazard and future development possibilities of an organization. A few credit facilities expect to integrate these perspectives for an organization to work well.

- Support of influence proportions and inclusion proportions, under which the bank may request that the enterprise looks after Debt/EBITDA at under 0x and EBITDA/Interest at more than 6.0x, in this way in a roundabout way confining the corporate from assuming extra obligation past a specific breaking point.

- Change of control arrangement, which implies that a predefined segment of the term loan must be reimbursed, on the off chance that the organization gets gained by another organization.

- Negative promise, which keeps borrowers from swearing all or a segment of its benefits for making sure about extra bank loans (in any event, for the subsequent lien), or offer of advantages without authorization

- Confining mergers and acquisitions or certain capital consumption

- The term loan can be of two kinds – Term Loan A "TLA" and Term Loan B "TLB". The essential contrast between the two is the amortization plan – TLA is amortized uniformly more than 5-7 years, while TLB is amortized ostensibly in the underlying years (5-8 years) and remembers a huge projectile instalment for the most recent year. As you speculated accurately, TLB is somewhat progressively costly to the Company for the marginally expanded tenor and credit chance (inferable from late head instalment).

Post a Comment